Market Comments: 1Q2024

According to the Bureau of Labor Statistics (BLS) the U.S. economy generated 303,000 jobs in March, well ahead of the consensus estimate of around 200,000 new jobs. Combined, BLS revised January and February numbers higher by 22,000 jobs. The results brought the three-month average payroll gains to 276,000, which is above the 12-month average of 231,000 and continues to signal a very robust job market.

The unemployment rate dropped to 3.8% from 3.9% in February, and average hourly earnings increased 4.1% year-over-year, compared to 4.3% through February. Jobs gains occurred primarily in healthcare, government and construction.

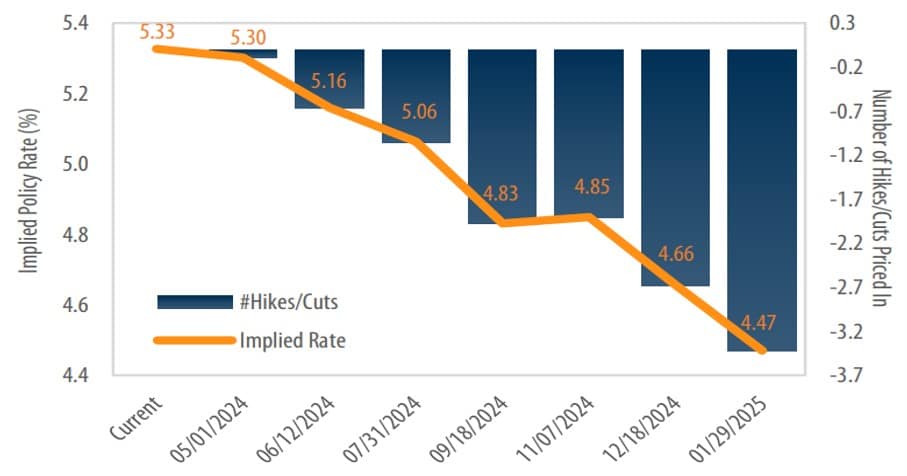

At the conclusion of its March meeting, the Federal Open Market Committee (FOMC) kept rates unchanged, as expected. The target rate remains at its highest level since 2000, at 5.25%-5.50%, and above its long-term average of around 4.5%. According to the Fed’s Summary of Economic Projections released after the meeting, the FOMC appears on track with a plan to lower rates by 0.25% three times in 2024, and potentially another three times in 2025.

While the Fed’s forecast of future rate changes has held steady, at least since late last year, investor expectations have shifted significantly the last few months. At the conclusion of the December Fed meeting, fed funds futures were pricing in six interest rate cuts of 0.25% in 2024, a stark contrast to the Fed’s forecast of three reductions.

Throughout the first quarter, investor sentiment shifted due to stronger than expected economic gains and sticky inflation. By any measure, inflation remains above the Fed’s 2% target. The most recent headline consumer price index (CPI) reading, through February, was 3.2%. By quarter-end, investor expectations aligned with the Fed’s forecast of three rates cuts this year.

IMPLIED FEDERAL FUNDS RATE & NUMBER OF HIKES/CUTS

Source: First Trust; Bloomberg, as of 3/29/2024. Assumed rate movement for one hike/cut is +/- 0.25%.

The U.S. economy extended its streak of consecutive quarters of economic growth to six in the fourth quarter of 2023. In its third and final estimate, the Bureau of Economic Analysis indicated real gross domestic product (GDP) grew at an annual rate of 3.4%. According to the Federal Reserve Bank of Atlanta, the way-too-early GDPNow forecast of first quarter economic growth is 2.5%. The first official GDP estimate will be released at the end of the month.

Stocks continue to exceed investor expectations. The Standard & Poor’s 500 Index returned 10.6% in the first quarter, while the Dow Jones Industrial Average and the NASDAQ Composite Index were up 6.1% and 9.3%, respectively. The Russell 2000 small cap index returned 5.2%. Though more muted than domestic markets, international stocks advanced too, with the MSCI EAFE Index and the MSCI Emerging Markets Index returning 5.9% and 2.4%, respectively.

Stock market valuations can be poor predictors of returns over the short-term but remain relevant in helping to inform investor expectations over longer periods. By about any measure, broad U.S. stock market valuations are stretched. The price-to-earnings ratio of the S&P 500 Index, for example, falls outside of a “normal” range. Simply put, investors must pay more today than in recent history to achieve the same level of earnings on an investment in the U.S. stock market.

FORWARD PRICE-TO-EARNINGS RATIO

Source: : Northern Trust Asset Management, Bloomberg. Normal Range is +/- 1 standard deviation from median. Monthly data beginning 12/31/1999, current as of 2/28/2024.

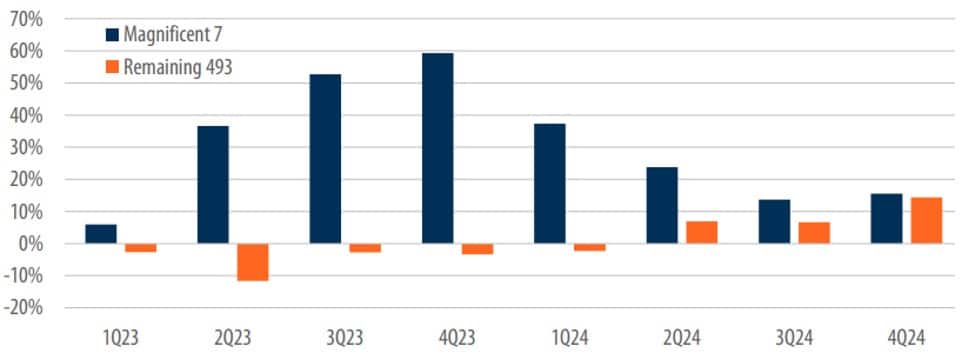

The “return concentration” that has been highlighted over the last year, almost ad nauseam, has distorted valuations. The so-called “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla), which have accounted for over 50% of broad market gains since the start of 2023, are also responsible for overvalued stocks. Without the Mag 7, the collective price-to-earnings ratio of the other 493 stocks in the S&P 500 fall within a normal range.

Stock market returns have broadened a bit since late October of last year. In 2024, analysts expect Mag 7 earnings to slow from the torrid pace of 2023, while forecasts suggest an increase in earnings growth of the rest of the market. If that occurs, the more attractive valuations of the “other 493” may warrant the attention of investors as the year progresses.

S&P 500 INDEX STOCKS QUARTERLY EPS GROWTH YEAR-OVER-YEAR

Source: First Trust; S&P Capital IQ. Data as of 3/28/2024

There are matters of concern that could impact economic growth, including rising credit card delinquencies and increases in premature withdrawals of retirement savings. Both items signal at least a segment of the population is becoming overstretched, primarily those in the bottom third of household income. However, overall debt servicing expenses remain reasonable compared to history. If inflation continues to abate, and employment and wage data remain stable, expect consumers to continue pushing the resilient U.S. economy forward.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that investment products are not FDIC insured, not bank guaranteed, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take any action which may be relevant to this information.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor