Market Comments: Q4 2025

January 2026

As a result of the record 43-day government shutdown that began October 1, many of the economic-related topics covered in these quarterly letters are incomplete, delayed or, in some instances, canceled altogether. Through the uncertainty of having much of the federal government, its various agencies, and the data they provide inaccessible throughout the closure and beyond, investors have continued making decisions and transacting, though with less clarity.

U.S. stocks finished 2025 at near-record highs and achieved a third consecutive year of double-digit returns. For the year, total returns for the Dow Jones Industrial Average, the Standard & Poor’s 500 Index, and the NASDAQ Composite Index were 14.9%, 17.9%, and 21.2%, respectively. The Russell 2000 (small cap) Index returned 12.8%.

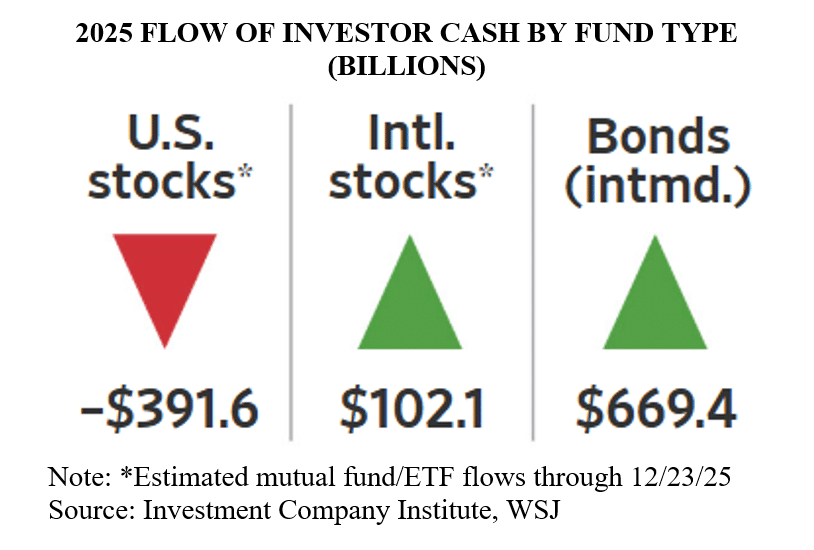

Given outsized performance, it is a bit surprising that investors withdrew nearly $400 billion (net) from U.S. stock mutual funds during the year. Buyers of individual securities, particularly shares of AI-related technology companies, picked up the slack, which helped power the U.S. market higher.

International stocks finished the year ahead of U.S. stocks, a theme present throughout 2025. The MSCI EAFE Index returned 32.0% for year, while the MSCI Emerging Markets Index returned 34.3%.

By any valuation measure, international markets are more attractive than domestic stocks. Even with last year’s runup, international developed and emerging market stocks are trading at around 18- and 17-times earnings, respectively, not far from long-term historic averages. U.S. stocks by contrast, are trading at nearly 28-times earnings, well above the long-term average price-to-earnings ratio of around18, according to MSCI.

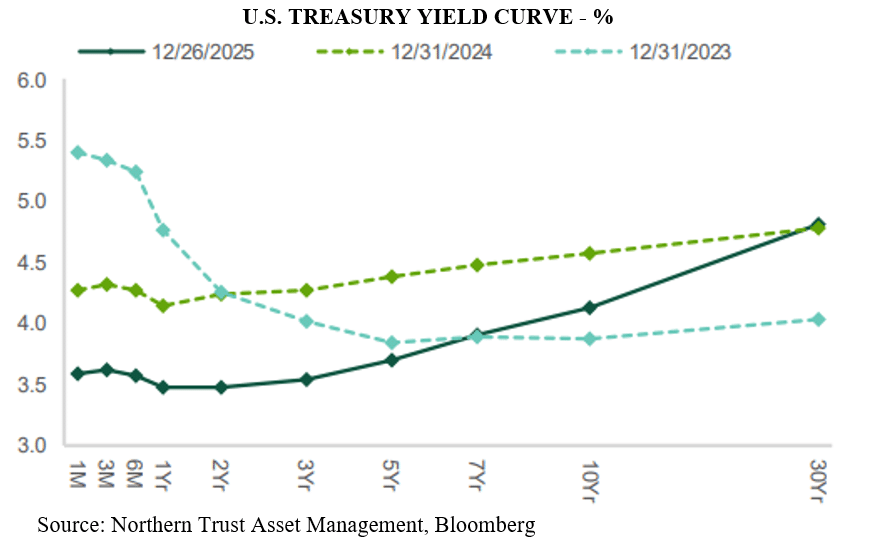

Interest rates declined along much of the U.S. Treasury yield curve during the year, including in most segments less impacted by “normal” Federal Open Market activity. Factors influencing investor demand for safe investments include weakening labor markets and global economic uncertainty. The benchmark 10-year Treasury, which began the year yielding nearly 4.60%, ended 2025 paying under 4.20%. Rate cuts by the Fed at its final three meetings of the year helped steepen the slope of the yield curve. For the year, the total return of the Bloomberg Aggregate bond index was 7.3%.

Since its reopening on November 12, government agencies are still playing catch up, including the Fed. By its own admission, policy makers were “flying blind” throughout most of the fourth quarter, though they did vote to lower the Fed Funds target rate by a quarter-percent in October and December, following an initial quarter-point cut in September.

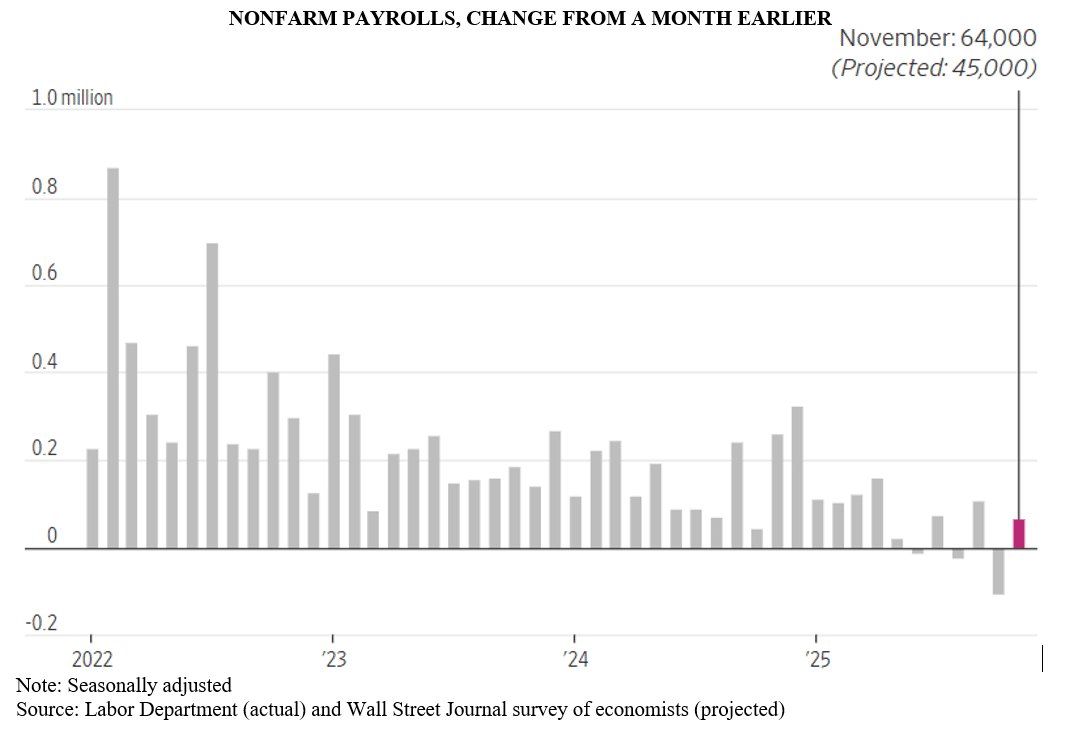

The rate cuts indicate the Fed shifted its view that sticky inflation was as great a threat to the economy as weaker employment data. Though not released until after the December Fed meeting, these two critical November economic reports – inflation and employment – affirmed the Fed’s decision to lower rates.

November jobs gains totaled 64,000, ahead of the 45,000 projected. However, the unemployment rate rose to 4.6%, its highest level in more than four years. The report also estimated that net job losses the prior month totaled 105,000 (the October employment report was canceled due to the shutdown). Without significant revisions, net job losses occurred in three of the last six months (June, August, October).

By contrast, inflation, the fear of which kept the Fed from lowering rates sooner, came in below expectations in November at 2.7%. Ahead of the report, a Wall Street Journal poll of economists projected November inflation to be 3.1%. Due to the government closure, however, data was only collected for part of the month and is widely viewed as incomplete and, therefore, unreliable.

The U.S. economy continues to grow despite myriad global economic and geopolitical uncertainty. In its initial projection of third quarter gross domestic product (GDP), also delayed, the Bureau of Economic Analysis projected the U.S. economy grew at a 4.3% annual rate, up from 3.8% in the second quarter. The main driver of growth was an acceleration in consumer spending.

With earnings announcements set to begin in the coming days, investors will be looking for clues as to what this year might bring. Average annual returns for the broad U.S. stock market (S&P 500) for the last 3, 5, and 10 years through 2025 were 23.0%, 14.4%, and 14.8%, respectively. While earnings have been strong, they have not kept pace with that level of price appreciation, hence the overvaluation and my expectation that returns will ultimately normalize, a claim I have expressed often recently, to no avail… yet.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor