Market Comments: Q1 2025

Concern over tariffs and a potential slowdown in the U.S. economy sent stocks lower in the first quarter. For the Standard & Poor’s 500 Index and the NASDAQ Composite Index, it was the worst quarter since 2022, when those two indices finished the year down 18.2% and 33.1%, respectively.

As of quarter-end, the S&P 500 and NASDAQ were down 4.3% and 10.3%, respectively, while the Dow Jones Industrial Average declined 0.9% and the Russell 2000 small cap index was down 9.5%. The selloff picked up steam early this month when details of the pending tariffs became clearer.

To little surprise, the brunt of the stock market weakness was felt in what were arguably the most overvalued sectors – Communication Services (down 6.2%), Consumer Discretion (-13.8%) and Information Technology (-12.7%) – that were the darlings of the previous two years. These three sectors hold the “Magnificent Seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) that were largely responsible, collectively, for the outsized stock market gains and bloated valuations in 2023 and 2024.

The only other sector to finish the quarter negative was Industrials, down just 0.2% through the first three months. The remaining seven sectors – Consumer Staples (+5.2%), Energy (+10.2%), Financials (+3.5%), Healthcare (+6.5%), Materials (+2.8%), Real Estate (+3.6%) and Utilities (+4.9%) finished the quarter in positive territory.

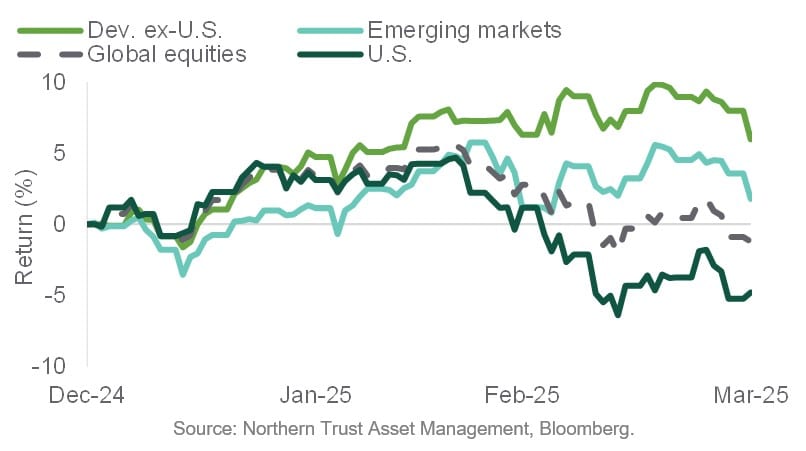

Beneficiaries of the selloff in U.S stocks were non-U.S. developed and emerging stocks, which have greatly lagged U.S. markets over the last decade. The MSCI EAFE Index returned 7.0% in the first quarter, while the MSCI Emerging Markets Index was up 3.0%.

GLOBAL STOCK PERFORMANCE FIRST QUARTER

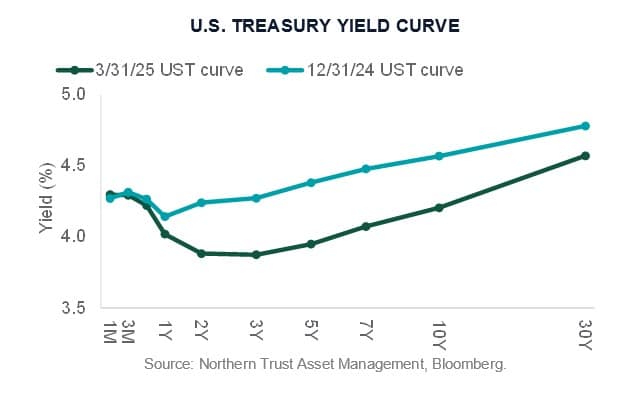

In addition to international stocks, market and economic uncertainty drove investors to seek out more conservative investments, including bonds. The risk-off shift to fixed income pushed bond prices higher and yields lower. The rate on the 10-year benchmark treasury, which began the year yielding close to 4.6%, was around 4.2% at quarter-end. The continued stock selloff in early April brought the 10-year treasury rate to around 4.0%.

For the quarter, the Bloomberg Aggregate Index returned 2.8%. Rates on the short end of the yield curve held steady, while the decline in rates noted above are evident in the shift in the overall shape of the U.S. Treasury yield curve from the start of the year to the recent quarter-end. The change reveals a clear “flight to safety” which is common during volatile stock market conditions.

Short-term rates were stable due to the Federal Reserve’s decision to maintain its target rate at both Federal Open Market Committee (FOMC) meetings in the first quarter. Fed policy decisions heavily influence short-term interest rates.

At the conclusion of its March meeting Chairman Jerome Powell indicated the Fed needed to “wait for further clarity” before making any monetary policy changes. The FOMC will be watching how Trump administration policy changes – most notably on trade, spending, taxes, and immigration – might alter the economic outlook. At the meeting, 11 of 19 policymakers projected the Fed would cut rates at least two times in 2025, down from 15 members projecting two or more cuts at the December meeting.

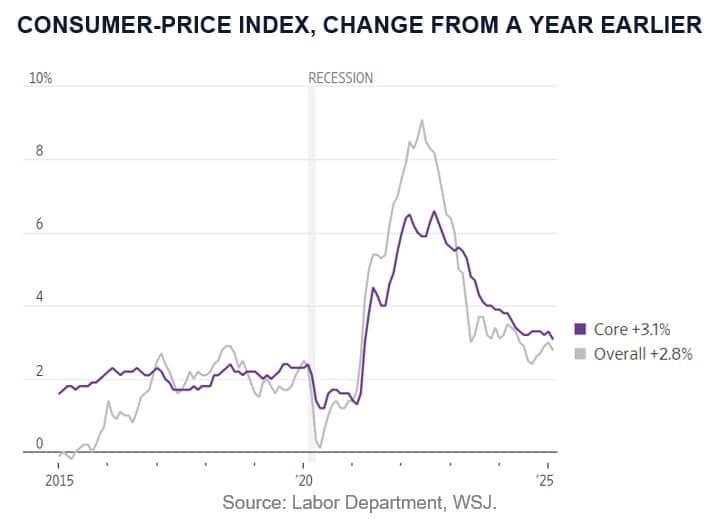

Also at the meeting, the Fed revised downward its projection for economic growth in 2025, from the 2.1% it forecasted in December to 1.7%. It also increased its inflation expectations, due to the potential impact of pending tariffs, from 2.5% at the January meeting to 2.7% last month.

The most recent consumer price index (CPI) inflation reading, through February, came in a bit below expectations at 2.8%. Through January, year-over-year CPI was 3.0%. The core reading, which excludes volatile food and energy prices to better capture underlying inflation trends, was 3.1%, its lowest reading since 2021.

March employment numbers were better than expected, with employers adding 228,000 new jobs, well above the 140,000 projected and the 158,000 average jobs created the prior 12 months. Services sector employment gains were strong, including in leisure and hospitality, healthcare, and transportation, while the Department of Government Efficiency’s (DOGE) federal government layoffs were a modest drag on payroll numbers. The unemployment rate ticked up a bit to 4.2% as more people entered the labor force.

No one enjoys experiencing declines in investment values. It is unnerving not knowing when things will stabilize. Sell-offs related to geopolitical events are often short-lived, with positive market returns often occurring within six months and one year from an “event.” We remain committed to adhering to our long-term investment discipline, including taking advantage of the periodic disruption that occurs over nearly every market cycle.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor