Market Comments: Q2 2025

July 2025

Stocks soared to new highs at quarter-end as investors brushed off tariff-related fears from early in the period. After declining nearly 19% from its previous all-time high on February 19 to its near-term low April 8, the Standard & Poor’s 500 Index climbed steadily throughout the remainder of the quarter. The 89-trading day period between record highs (February 19 to June 27) marked the quickest-ever recovery back to a new closing high following a decline of at least 15%. Through June 30, all major U.S. stock market indices were positive, both for the second quarter and year-to-date.

The S&P 500 returned 10.9% in the second quarter, while the Dow Jones Industrial Average, the NASDAQ Composite Index returned 5.5%, 18.0%, and 8.5%, respectively. Through the first six months of 2025, the S&P 500, the Dow, and the NASDAQ returned 6.2%, 4.6%, and 5.9%, respectively.

While the second quarter rally lessened the gap, U.S. stocks did not catch their international counterparts. The MSCI EAFE Index and MSCI Emerging Markets Index, which returned 12.0% and 12.2%, respectively, in the second quarter, were up 19.9% and 15.5%, respectively, year-to-date through June 30.

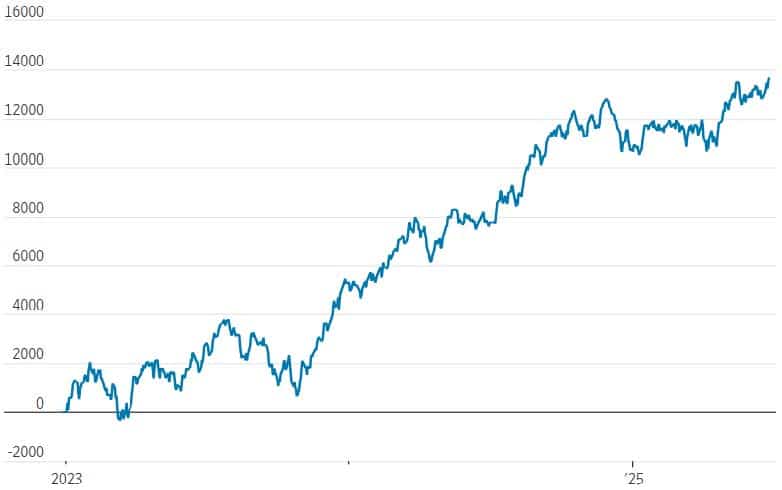

S&P 500 Advance-Decline Line

A shift of sorts occurred in the second quarter as it relates to the breadth of stocks participating in the rally. While much of the stock gains of the previous two years were driven by a small number of mega cap technology stocks, including the “magnificent seven,” participation broadened from the April 8 lows. This is reflected in the S&P 500 advance-decline line, a technical indicator that subtracts the number of declining stocks in an index from those advancing each day and adding the difference to the previous day’s total.

Interest rates fluctuated throughout the second quarter. U.S. Treasuries sold off mid-quarter after Moody’s downgraded U.S. government debt from triple-A, then days later the Congressional Budget Office (CBO) reported it expected the fiscal budget package that was nearing passage in the House would add $2.4 trillion to budget deficits over the next 10 years.

CBO estimates, though, assumed the tax cuts passed in 2017 would fully expire, which was never truly expected to occur. As quarter-end neared, mild inflation data, higher than anticipated tariff revenue, and an expectation that the Federal Reserve would resume interest rate cuts by the fall, helped ease much of the concern. Amidst all the uncertainty and subsequent volatility, U.S. Treasuries rallied at the end of the quarter. As of June 30, the yield on the benchmark 10-year Treasury, at 4.24%, was about the same as where it began the period.

In remarks made to lawmakers near the end of the quarter, Fed Chairman Jerome Powell indicated recent economic data likely would have justified continuing to lower interest rates if not for concerns that higher tariffs may restart inflation. In responses to questions from Congress, Powell implied a low probability of a rate cut at this month’s meeting, which concludes July 30. Investors feel the same way, with fed funds futures at quarter-end indicating less than a 20% probability of a rate cut at the July meeting. Futures for the following meeting signify the Fed will cut rates by a quarter-point when it concludes its second and final third quarter meeting on September 17.

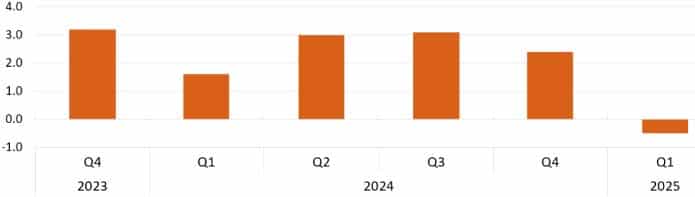

The Bureau of Economic Analysis reported the U.S. economy contracted in the first quarter. Last month’s final estimate of real GDP growth for the first three months of 2025 was -0.5%, 0.3% lower than the previous estimate of -0.2%. The decrease in real GDP reflected a decrease in government spending and an increase in imports (imports are subtracted from the GDP calculation). Many businesses and consumers increased spending on imported goods in the first quarter to front-run potentially higher prices from anticipated tariff increases.

S&P 500 Advance-Decline Line

Note: Seasonally adjusted annual rates

Source: Bureau of Economic Analysis

The job market remained strong in the second quarter, defying widespread concern that tariffs, government agency job cuts, softer business and consumer confidence, and a shift in policies related to immigration enforcement would result in weak employment numbers. In June, the U.S. economy added 147,000 new jobs, well ahead of the 110,000 forecasted. Revisions to the April and May employment reports added an additional 16,000 jobs, bringing the three-month average through June to 150,000 jobs gains. The previous three-month average, through May, was 135,000 jobs.

The Bureau of Labor Statistics (BLS) U.S. Diffusion Index, which reflects the proportion of industries experiencing employment changes, showed a significant improvement in the manufacturing sector, a focal point of Trump Administration policies. In June, the Index jumped from 40.3% to 52.1%. A reading above 50% indicates most industries are experiencing job gains, while anything below 50% suggests most industries are experiencing weaker employment.

The unemployment rate in June declined to 4.1%, from 4.2% in April and May, also defying expectations. Federal government employment has declined by 69,000 since January, far below the 288,000 layoffs announced thus far. In its June report, the BLS reiterated that government employees on paid leave or receiving severance pay are still counted as employed in the recent survey. Government employment declines are anticipated to be more accurately reflected in employment reports starting as early the fall.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor