Market Comments: Q3 2025

October 2025

After failing to agree on a short-term spending plan, Congress forced a shutdown of the federal government effective October 1. Among the ramifications is a halt to the release of some of the data used to determine the health of the U.S. economy, including the monthly employment reports typically announced the Friday following month-end.

The most recent report available, for August, showed a continued slowdown in the pace of hiring, with just 22,000 new jobs created for the month. Estimates were for gains of around 75,000. Included in the August release was a revision to the June report that resulted in a net loss of 13,000 jobs for that month, the first monthly decline since the pandemic. The unemployment rate rose to 4.3% in August, from 4.2% the previous month. The still-low unemployment rate indicates immigration restrictions are reducing the supply of available workers.

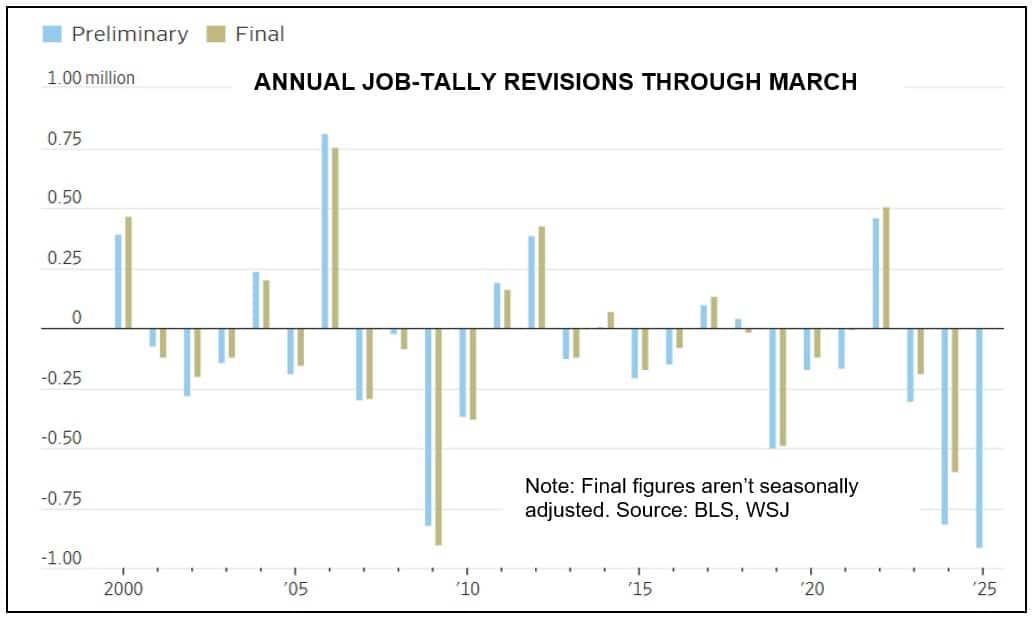

Days after the August employment report, the Bureau of Labor Statistics (BLS), in its annual review of employment data covering the April to March period, estimated 911,000 fewer jobs were created than previously reported over the 12 months ending March 31, 2025.

Because the BLS uses business “birth-death models” and employer surveys in its employment reports, monthly data can be inaccurate and often overstates the initial job growth reported, which has occurred often in recent years. Hence, the need for the annual revisions.

If estimates in the revised report hold when the final data is released later this year, average monthly gains over the 12-month period would be around 70,000, far below the nearly 150,000 originally reported.

Inflation rose to its highest level since the start of the year, at 2.9% year-over-year through August. Prices have risen in important consumer goods categories like clothing and cars, as well as in essentials like housing and food. While not as bad as originally feared after the spring tariff-increase announcement, higher prices coupled with a weakening labor market are creating fears the U.S. could be headed toward a period of stagflation, in which overall economic growth slows while inflation persists.

These dueling data points are evident at the Federal Reserve, which refrained from making any rate adjustments this year until its September meeting. The announcement of a quarter-point rate cut last month, its first since December last year, implied the Fed is prioritizing weaker employment over sticky inflation. More cuts are expected at the final two meetings this year. Fed funds futures currently place the probability of quarter-point cuts in both October and December at above 90% and 80%, respectively.

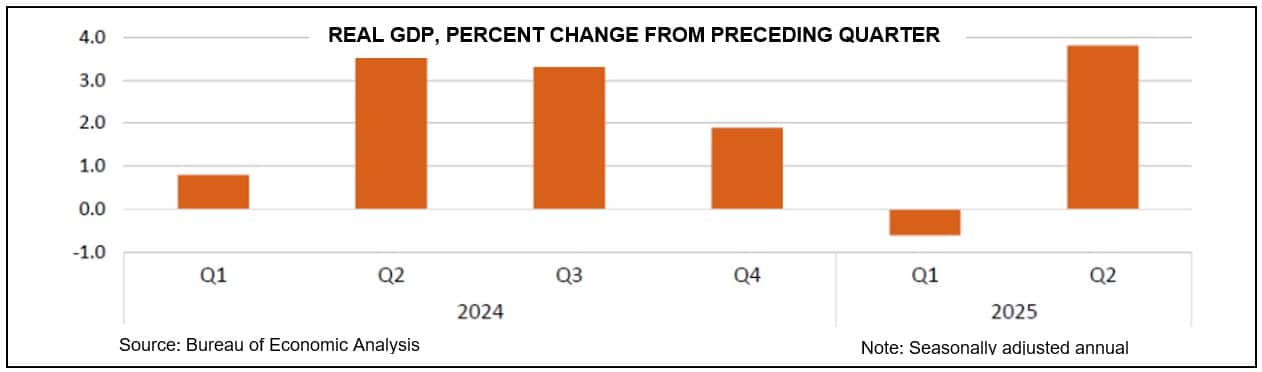

The U.S. economy recovered from the first-quarter contraction. According to its final estimate of real gross domestic product (GDP), the U.S. Bureau of Economic Analysis reported the economy grew 3.8% in the second quarter. The upturn primarily reflected a decline in imports and an acceleration in consumer spending, offset by a falloff in business spending and a slight reduction in government spending.

U.S. stocks continued higher in the third quarter, with the Dow Jones Industrial Average closing the period at a new all-time high. The Dow returned 5.7%, its best quarterly performance since the same period last year. The Standard & Poor’s 500 Index and the NASDAQ Composite Index returned 8.1% and 11.4%, respectively, ending the quarter slightly below the all-time closing highs of those indices earlier in the month.

Through September, year-to-date total returns for the Dow, the S&P 500, and the NASDAQ were 10.5%, 14.8%, and 18.0%, respectively. The Russell 2000 (small cap) Index, which was down 1.8% through the first six months, returned 12.4% in the third quarter and finished the period up 10.4% year-to-date.

Third quarter performance in international markets was strong too, with the MSCI EAFE Index and MSCI Emerging Market Index up 4.9% and 10.9%, respectively. Year-to-date through September, international stocks continued to outpace domestic markets, with the two indices returning 25.8% and 28.2%, respectively.

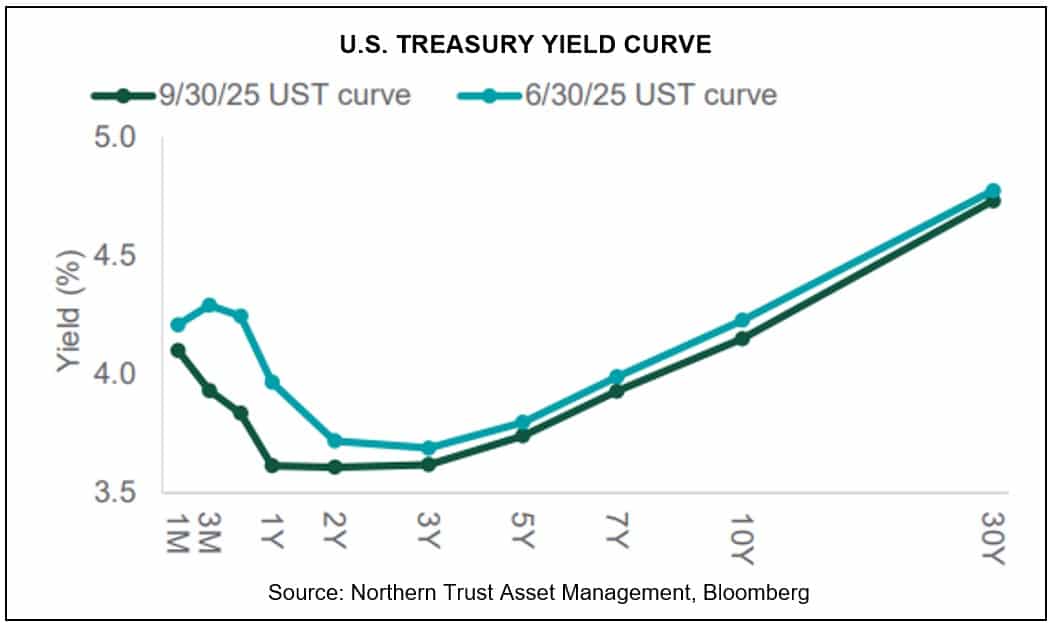

As anticipated, given the shift in monetary policy, interest rates declined in the third quarter. Though the drop was most notable on the short end of the U.S. Treasury yield curve, which is heavily impacted by shifts in central bank policy changes, rates drifted modestly lower across the remainder of the curve as well.

With more rate cuts anticipated in the coming months, a continuation of yield curve “normalization” should occur, reducing or possibly eliminating the segments of the curve that remain inverted (i.e. short-term rates are higher than long-term rates.)

The impact of the federal government shutdown on the U.S. economy will likely depend on how long it takes for Congress to come to a resolution. To some degree, nearly all contributors to the U.S. economy rely on a functioning federal government. While government employees and entities will experience it more directly, many businesses have government contracts, while consumers and investors rely on government data to support critical decision making.

While most prior shutdowns have been resolved quickly, politicians today seem less inclined to offer concessions to the opposition party that could be portrayed as a victory to them. Let’s hope this time, as in prior budget disputes, party leaders will determine to put the country above their respective agendas.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor