It's easy to stay on top of your credit

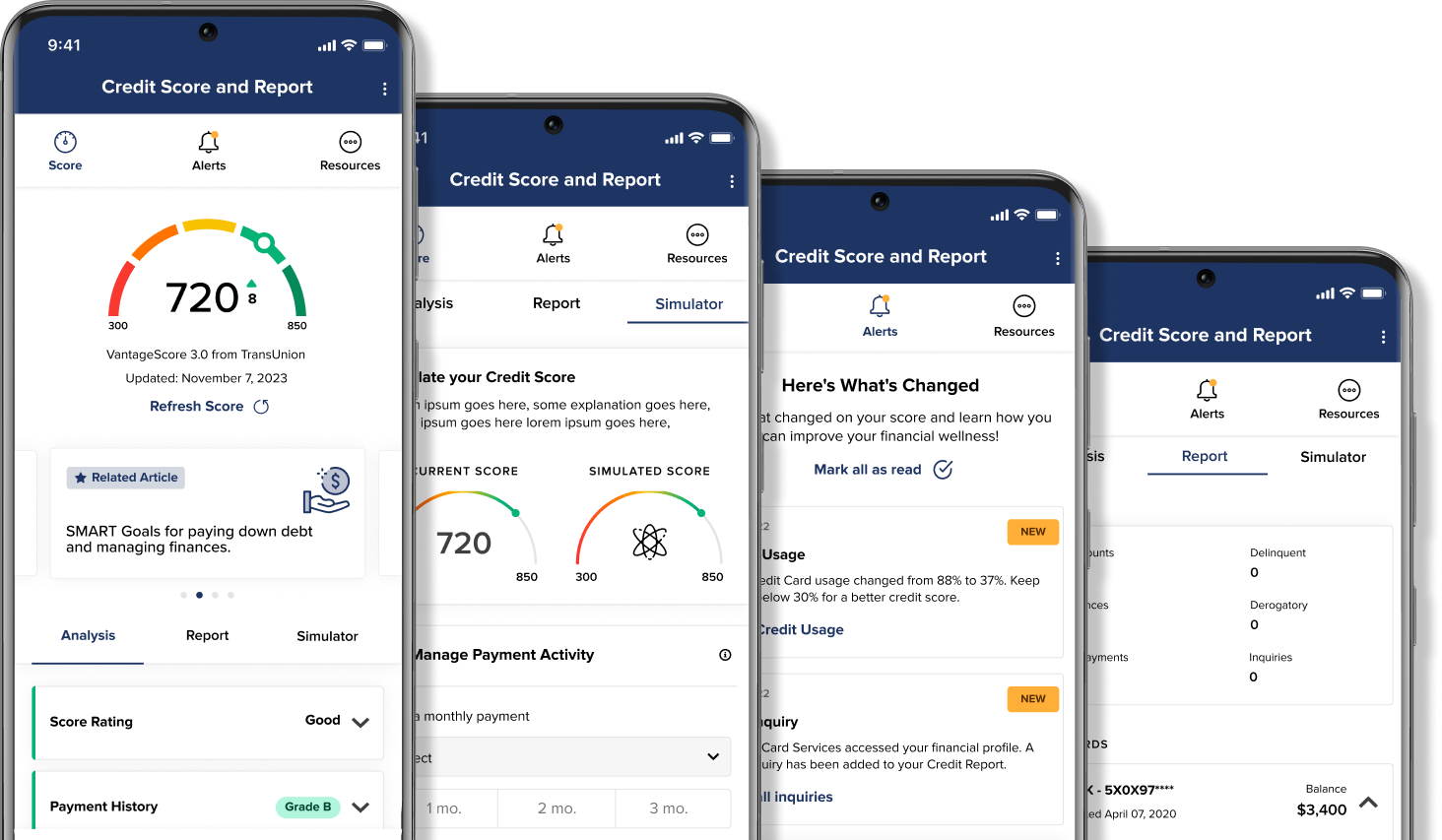

Credit Sense is a powerful tool that gives you access to your credit score, full credit report, credit monitoring, financial tips and education. The best part of it is, there’s zero impact to your credit score.

As a Park customer, you can take advantage of this tool and use the information anytime and anywhere through online banking or our mobile app – for free.

Simply click the Login button at the top of the page or open our app to check it out.

- Daily access to your credit score

- Real-time credit monitoring alerts*

- Credit score simulator

- Personalized credit report

- Credit Score Goals to help improve your score

- And more!

Your credit score and more is at your fingertips. Get started today!

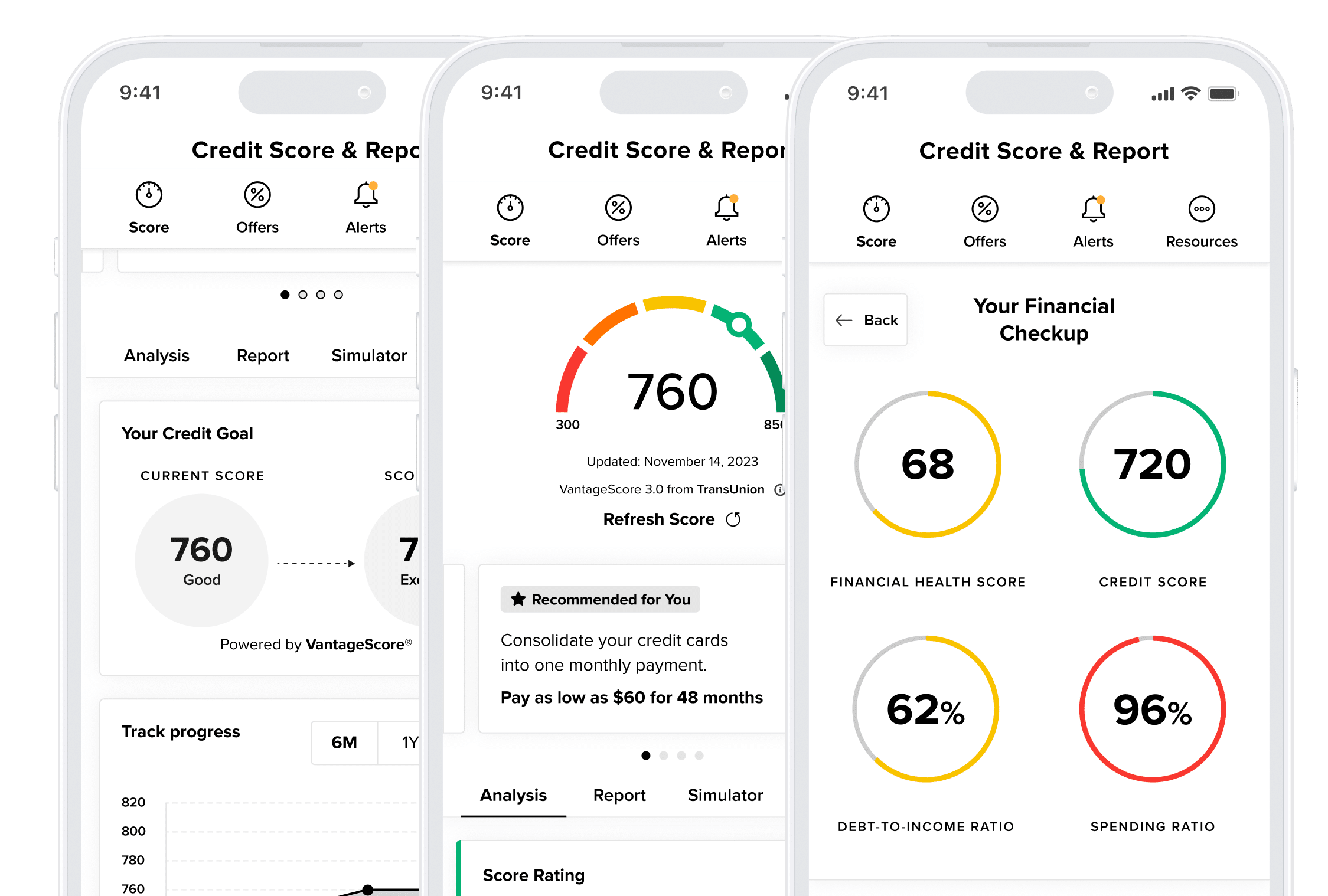

An empowering feature to help you have a healthier financial future. Just answer a few questions about your spending habits and how you feel about your finances, then get personalized guidance on how to improve your financial health based on your future goals. You’ll get:

- FinHealth Score® of your overall financial well-being

- A personal budget breakdown of how you are spending today

- Analysis of your debt-to-income ratio

- Personalized suggestions for improvements

Frequently Asked Questions

Credit Sense is designed to help you stay on top of your credit. It provides your latest credit score and report along with educational information about key factors that impact your score. It monitors your credit daily and emails you if any significant changes are detected (ex: new account being opened, address or employment change, delinquency or inquiry reported).

Yes! Credit Sense monitors and sends email alerts when there’s a change to your credit profile.

No! It’s completely free for Park customers.

Credit Sense is considered a soft inquiry and does not affect your credit score.

Your credit score updates every seven days. You can click “refresh score” as often as every day to see your updated score.

Credit Sense does its best to show the most relevant information from a credit report. If you think some information is wrong or inaccurate, you can request a free credit report from annualcreditreport.com and then dispute inaccuracies with each bureau individually. Each bureau has its process for correcting inaccurate information, but every Park National Bank Credit Sense user can “file a dispute” with TransUnion by clicking on the “dispute” link within Credit Sense. TransUnion will share this with the other bureaus if the inaccuracy is verified.

Three major credit-reporting bureaus (Equifax, Experian and TransUnion) and two scoring models (FICO or Vantage Score) determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 credit report factors may be considered when calculating a score, and each model may weigh credit factors differently, so no scoring model is identical.

No. Park pulls credit directly from credit bureaus and uses a separate underwriting process for making loan decisions.

*Standard messaging and data rates may apply. Check with your mobile or internet provider for details and rates.

Financial Checkup leverages the Financial Health Network FinHealth Score® Toolkit.