Market Comments: Q42023

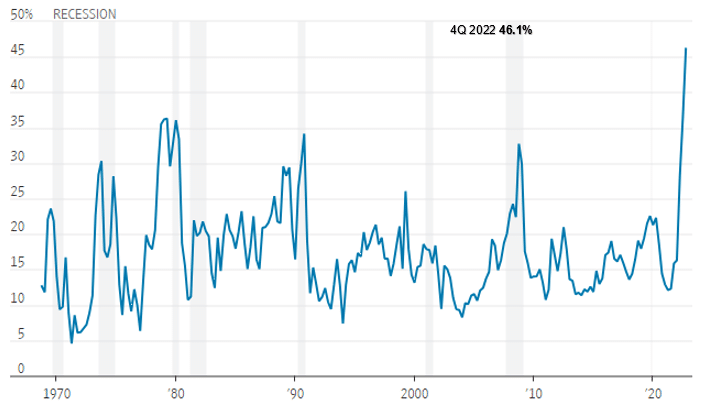

Expectations for a pending recession were high entering 2023, perhaps as high as at any time in recent history. Late in 2022, the regular Wall Street Journal survey of economists indicated a 63% probability of a recession in the coming 12 months. A similar survey of economists and investors, conducted by the Federal Reserve Bank of Philadelphia, showed expectations that gross domestic product (GDP) would decline over the coming four quarters. According to responses gathered by the Philadelphia Fed, the probability of a decline in GDP was the greatest since the survey began in 1968.

Average probability of shrinking GDP four quarters ahead

Note: Quarterly data | Source: Federal Reserve Bank of Philadelphia; WSJ

Actual economic growth appears to have played out much differently. According to the Bureau of Economic Analysis, real GDP in the first three quarters of 2023 was 2.0%, 2.1% and 4.9%, respectively. While the first official estimate of fourth quarter GDP will not be released until late this month, the current GDPNow forecast from the Federal Reserve Bank of Atlanta pegs estimated growth in the final quarter at 2.5%.

Consensus expectations for a weaker economy were well-founded, at least if history is any indicator. The Federal Open Market Committee (FOMC) was in the midst of its most aggressive rate-hike campaign since the late 1970s in an effort to slow the highest inflation experienced since that same period. Back then, in relatively short order, two recessions actually followed the FOMC tightening.

Another reliable indicator of pending economic weakness is an inverted yield curve, when long-dated bond yields are lower than those maturing soon. Recessions almost always follow yield curve inversions. They also serve as a sign that the Fed is close to winning its fight against inflation, no matter the cost to the economy. The “spread” between the three-month Treasury Bill and 10-year Treasury Note turned negative in November 2022, and reached its highest level in over 20 years in December that year.

The question on everyone’s mind as we enter 2024 is whether the economy has achieved a “soft landing” or, rather, has the inevitable simply been delayed. Much like last year, there are widespread calls for a recession to occur at some point in 2024, most likely in the mid to latter part of the year.

The most recent inflation reading, through November, showed year-over-year inflation (CPI) at 3.1%, its lowest level since September 2021. The estimate was in line with expectations, slightly below the October reading of 3.2%, and a dramatic improvement over the cycle-peak 9.1% rate from June 2022.

Perhaps the biggest factor in the economy continuing to grow amidst many challenges has been the resilience of the U.S. consumer, aided by continued job growth. According to the Bureau of Labor Statistics, the U.S. economy generated 216,000 new jobs in December. The results were better than expected, though jobs gains in October and November were revised lower by 71,000. The revisions took the three-month average to 165,000, below average monthly gains of 225,000 over the calendar year. The unemployment rate was unchanged at 3.7%.

As with overall economic activity, stock market performance defied the muted expectations of most investors entering the year. The Dow Jones Industrial Average achieved several new all-time highs during a two-month long, year-end rally. The broad U.S. stock market, as measured by the Standard & Poor’s 500 Index, closed 2023 less than one percent from its all-time high.

For the year, the Dow, the S&P 500 and the NASDAQ Composite Index returned 16.2%, 26.3% and 44.7%, respectively. A decent amount of those returns was achieved in the final quarter, with the three indices returning 13.1%, 11.7% and 13.8%, respectively, the final three months.

International stocks performed well too, with the MSCI EAFE Index and the MSCI Emerging Markets Index returning 19.0% and 10.1%, respectively, in 2023. As with U.S. stocks, the year-end rally helped push the indices much higher, with returns of 10.5% and 7.8%, respectively, in the fourth quarter.

Perhaps the biggest beneficiaries of the stock market’s late-year climb were small company stocks. Small cap investors cheered improved prospects of a soft economic landing and the higher probability, perhaps sooner and more rapid than previously expected, of lower interest rates in 2024. The Russell 2000 small cap index, which was down 4.5% year-to-date through October, finished 2023 with a total return of 16.9%.

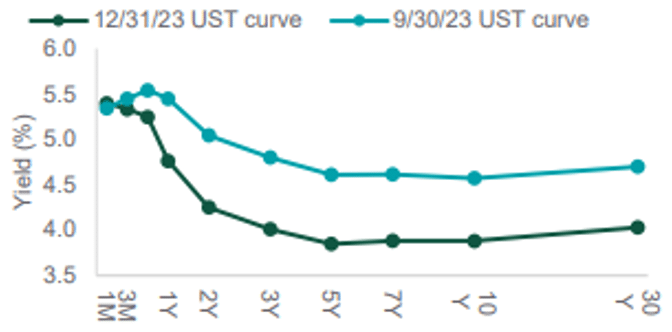

Interest rates moved sharply lower in the fourth quarter. Following peak cycle-highs in October, the 2-year and 10-year Treasury Note yields declined around 0.70% and 0.80%, respectively, in the final quarter. By year-end, Fed Funds futures indicated the likelihood of a first rate cut in March (previously it was July), with a total of six cuts (up from three), over the course of the year.

U.S. Treasury (UST) Yield Curve

Source: U.S. Treasury; Northern Trust Asset Management

Almost half of the global population will have an election this year. With political tension high both in the U.S. and abroad, investor focus may shift from economic to geopolitical. Though the U.S. presidential election will be the headliner, other faceoffs, including the January 13 presidential election in Taiwan, have the potential to impact global geopolitical tension significantly, as will the continued wars being fought around the globe.

As always, we will continue to maintain our focus on what we can control, not on what we cannot. At the forefront will be adhering to our long-term, disciplined approach to investing, which focuses on taking suitable levels of risk, and maintaining asset allocation strategies through ever-evolving market, economic and geopolitical conditions.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that investment products are not FDIC insured, not bank guaranteed, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take any action which may be relevant to this information.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor