Market Comments: 4Q2024

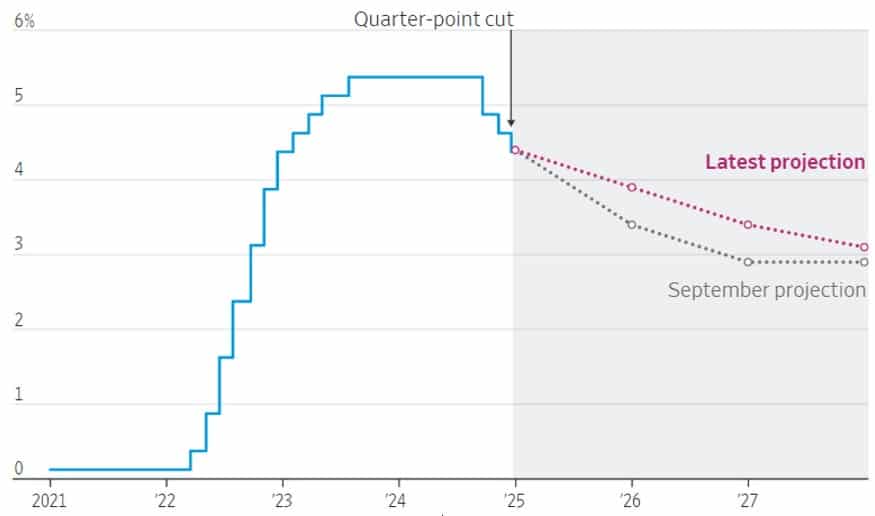

At its final 2024 meeting in December, the Federal Reserve lowered the federal funds target rate by 0.25%. This followed the same quarter-point reduction at the November meeting and the 0.50% cut in September. Following the half-point September rate cut, its first since the onset of the pandemic, the Fed implied a steady sequence of additional cuts could follow.

After the December meeting, it was clear opinions had shifted. In post-meeting comments, Fed Chairman Jerome Powell suggested there was less consensus by members to make another cut, and said, “From here, it’s a new phase, and we’re going to be cautious about further cuts.” The shift in sentiment is evident in comparing the recent projection of rate cuts to those at the September meeting.

FEDERAL-FUNDS TARGET RATE

Note: Chart shows media projections for the midpoint of the target range

Source: Federal Reserve, WSJ

A primary reason for the shift in the outlook has been sticky inflation. After steady progress following the post-pandemic, stimulus-fueled inflation that peaked in mid-2022, further declines have stalled of late and remain above the Fed’s two-percent target. The most current data available (through November) show the consumer price index (CPI) and the personal consumption expenditures (PCE) index at 2.7% and 2.4%, respectively, year-over-year. Both readings were higher than at the previous month-end.

Another factor potentially weighing on the minds of the Fed, economists and investors is that expected policy changes likely to be implemented by the incoming administration – including tariffs, tax cuts and reduced regulation – will fuel inflation. A counter argument to that premise is that similar shifts in policy during the first Trump administration did not result in price pressure, as inflation remained at or below two percent for the entirety of the term.

The change in projections for Fed rate cuts after the December meeting weighed on stocks, but not enough to derail a second consecutive year of outsize returns. Combined, returns from 2023 and 2024 represented the best two-year stretch for stocks since the period from 1997 through 1998. Incidentally, that was the latter part of the technology bubble that was soon followed by three consecutive years of negative stock market returns (2000-2002). The only other such stretch was during the Great Depression, when stocks declined four straight years (1929-1932).

For the year, stock returns surpassed expectations. I probably made a similar comment last year. Total returns in 2024 for the Dow Jones Industrial Average, the Standard & Poor’s 500 Index and the NASDAQ Composite Index were 15.0%, 25.0% and 29.6% respectively. Small company stocks lagged their large-cap counterparts, with the Russell 2000 Index returning 11.5% in 2024.

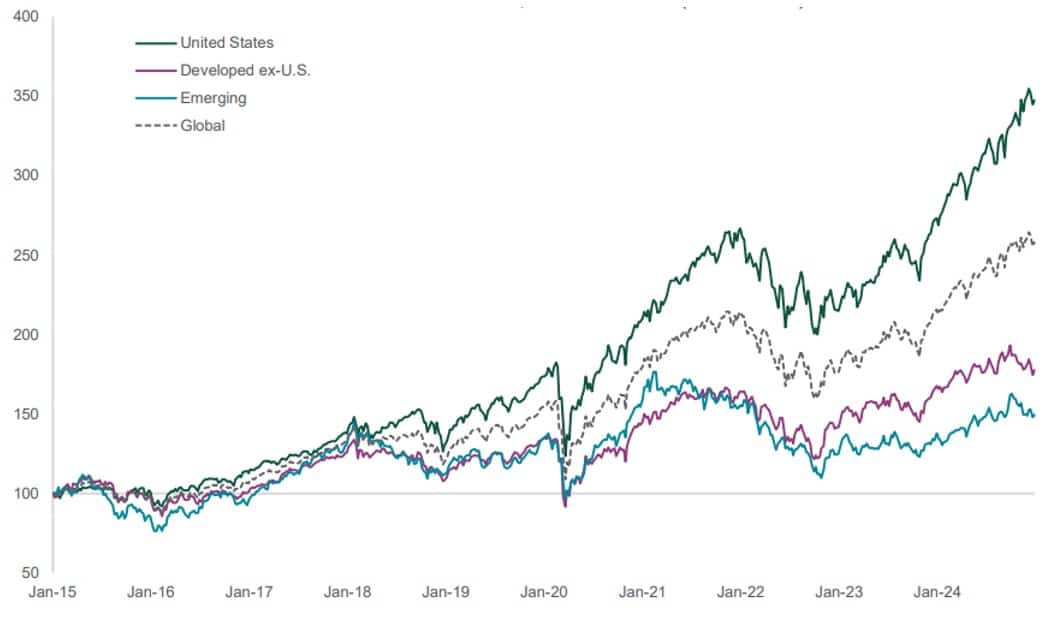

As has been a common theme in most of the last 10 years or more, domestic stocks outperformed non-U.S. stocks by a wide margin. For the year, the MSCI EAFE Index and the MSCI Emerging Markets Index returned just 4.4% and 8.0%, respectively.

TOTAL RETURNS OF GLOBAL EQUITY MARKETS, LAST DECADE (SET TO 100)

Source: Northern Trust Asset Management, MSCI, Bloomberg

After lagging a bit in the third quarter, the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) regained traction in the fourth quarter. Collectively, these stocks accounted for more than 53% of the total return of the S&P 500 Index in 2024. By itself, AI chip maker Nvidia made up about 21% of the Index’s return.

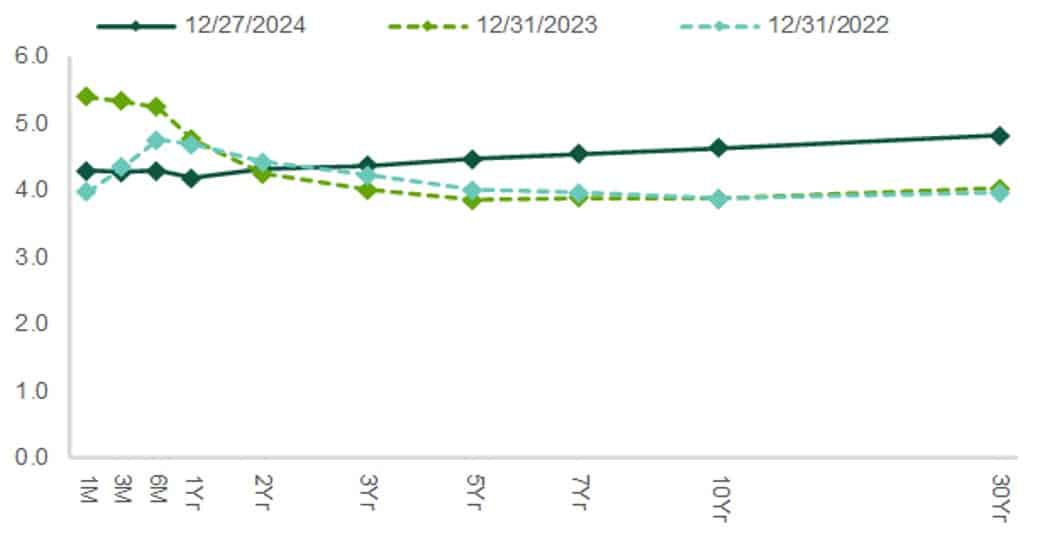

Even while the Fed was lowering its target rate, yields on U.S. Treasury securities outside of six months have climbed since the start of the reduction cycle, with 20 and 30-year Treasuries now approaching five percent. Unlike the inversion present most of the last two years, the shape of the U.S. Treasury yield curve has normalized and is now positively sloped.

U.S. TREASURY YIELD CURVE – %

Source: Northern Trust Asset Management, Bloomberg

The U.S. economy continues its growth trajectory, with an 11th consecutive quarter of gross domestic product (GDP) growth widely expected when fourth quarter 2024 data is released later this month. GDP growth for the third quarter was better than expected at 3.1%, and the current run is expected to continue into the new year. With stock market valuations stretched entering 2025, expectations for a continuation of the last two years are muted. However, similar valuations and expectations were present a year ago, which serve as another reminder of why attempting to time the market is futile.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor