Market Comments: 2Q2024

Entering 2024, expectations were for the Federal Reserve to begin cutting interest rates near the end of the first, or early in the second quarter. Fed funds futures at the start of the year were pricing in three quarter-percent rate cuts by mid-year and around a dozen by the end of the year. Over the first six months, however, inflationary pressure persisted, and the “higher for longer” rate narrative present throughout 2023 returned.

At the conclusion of the Federal Open Market Committee’s (FOMC) June meeting, the Committee’s median rate projection implied just one quarter-percent rate cut by year-end. Since that meeting, both inflation data and the June employment report, the primary drivers of recent FOMC policy expectations, have weakened a bit, bringing rate cuts back into view. Fed Chairman Jerome Powell, at a recent gathering with other central bankers in Portugal, said the economy had “made quite a bit of progress” toward cooler inflation with stable growth.

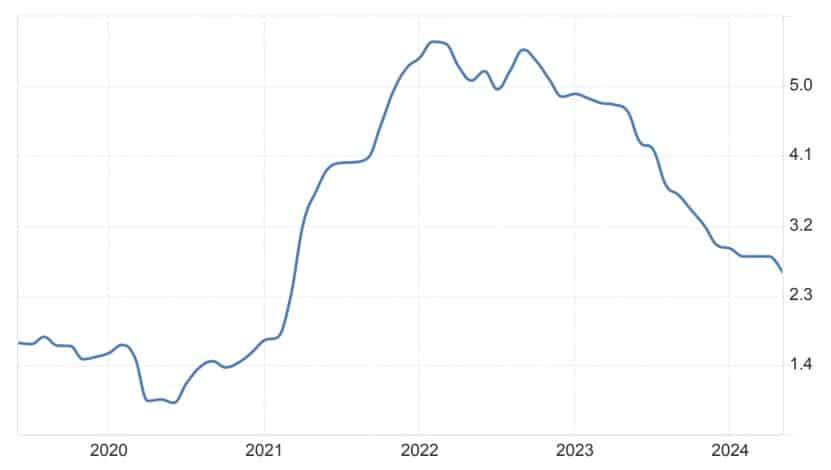

The Fed’s preferred inflation gauge is the personal-consumption expenditures (PCE) index, specifically the “core” PCE, which removes volatile food and energy prices. In May, the most recent data available, core PCE rose 2.6% year-over-year. The figure was below April’s 2.8% reading and represents the lowest increase since March of 2021. It remains above the Fed’s 2% target.

U.S. CORE PCE INDEX ANNUAL CHANGE (%)

Source: tradingeconomics.com; U.S. Bureau of Economic Analysis

According to the Bureau of Labor Statistics, 206,000 new jobs were created in June, slightly above consensus estimates of 190,000. Downward revisions to the April and May reports took the three-month average to 177,000, which is below the 12-month average of 220,000 and indicative of a cooling job market. The unemployment rate increased to 4.1%, from 4.0% the previous month.

The U.S. economy continues its growth trajectory, though the pace has moderated. The final estimate of first quarter gross domestic product (GDP) growth was 1.4%, a sharp pullback from the 3.4% pace during the last quarter of 2023, and the slowest quarterly GDP growth since the spring of 2022. Data suggests consumer spending slowed, growing just 1.5% over the first three months, a sign higher interest rates may be taking a toll on the economy.

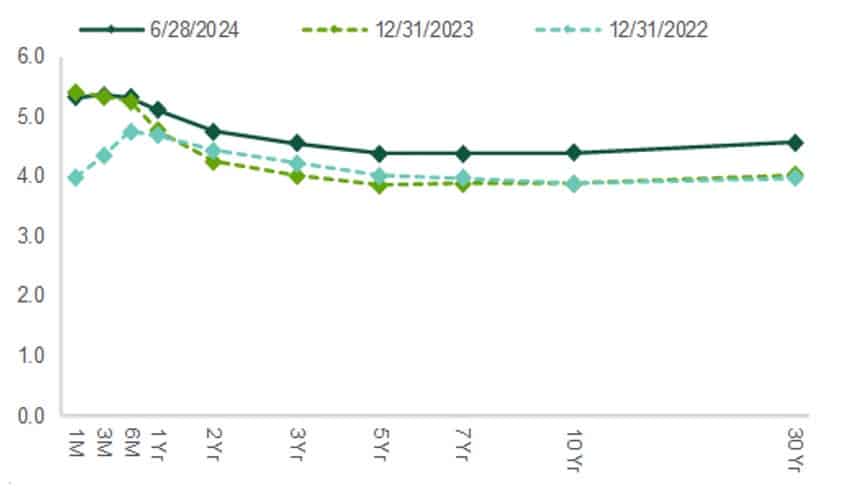

Rates across most of the U.S. Treasury yield curve rose in the first six months of the year. The curve remains inverted, meaning short-term rates are higher than long-term rates. An inverted yield curve is indicative of elevated expectations of a pending recession. There is no significant threat of a recession in the near-term, and forecasts for interest rates indicate that by year-end 2025 short-term rates will be lower by around 100 basis points (1.0%), and that the U.S. Treasury yield curve will be “normal” and upward-sloping again. It has been inverted for well over a year.

U.S. TREASURY YIELD CURVE

Source: Northern Trust Asset Management; U.S. Treasury

Stocks continue to defy even the rosiest of expectations, as they did last year. In the second quarter, the Standard & Poor’s 500 Index and the NASDAQ Composite Index returned 4.3% and 8.5%, respectively, driven by the continued artificial intelligence (AI) frenzy. The Dow Jones Industrial Average stumbled a bit, declining 1.3% in the second quarter. Over the first six months, the Dow, the S&P 500, and the NASDAQ were all positive, returning 4.8%, 15.3% and 18.6%, respectively.

As has been a consistent theme of late, the performance of international stocks, and stocks of small and mid-size domestic companies, have lagged large-cap domestic stocks. The MSCI EAFE and MSCI Emerging Markets indices returned 5.8% and 7.6%, respectively, through the first six months, while Russell 2000 (small cap) Index and Wilshire Mid-Cap Index returned 1.7% and 4.0%, respectively.

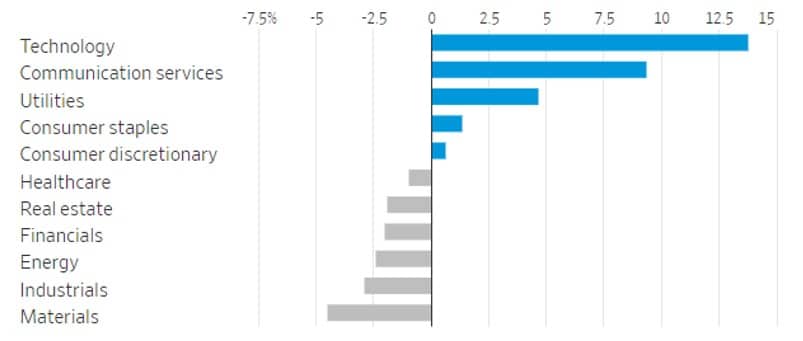

One should look no further than the performance of AI-related stocks to understand the cause of the performance disparity. In the second quarter, AI-themed companies in the S&P 500 gained nearly 15% in market value, while the rest, collectively, lost market value. Only five of eleven sectors had positive returns. Utilities companies participated in the fury too, with the expectation that new data centers will fuel electricity demand.

S&P 500, TOTAL RETURN IN SECOND QUARTER 2024, BY SECTOR

Source: WSJ, FactSet

To be sure, it is not just speculation reminiscent of the dot.com boom in the 1990s driving interest in artificial intelligence. Heavy spending on AI technology has boosted earnings so much so that overall valuations remain relatively stable. The question is whether, and how long, it will continue.

Uncertainty remains, including politically. By the end of this year, balloting covering 40% of the global population and over half of the world’s economic output will have taken place. So far, over a billion people around the globe have voted. It has been a difficult cycle for both moderates and incumbents. The increase in uncertainty within our own political parties, post-debate, will likely impact market and economic conditions in the near-term. As always, our focus will remain on what we can control, not on what we cannot.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor