Market Comments: 3Q2024

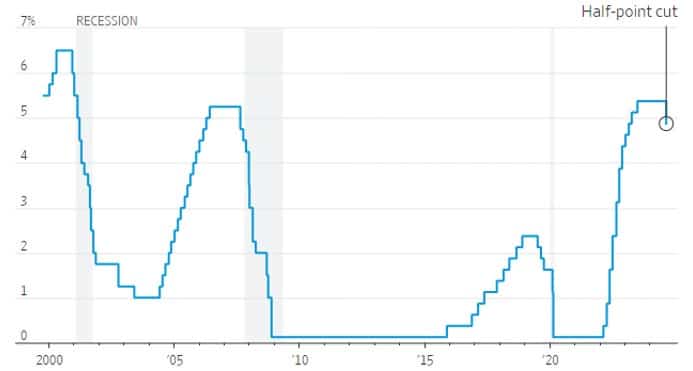

The Federal Reserve voted to lower interest rates by a half-percentage point at its September meeting, though the decision was not unanimous. For the first time in nearly 20 years, a dissenting vote was cast, with Fed Governor Michelle Bowman favoring only a quarter-percent point reduction. In post-meeting comments, Governor Bowman indicated a concern that the larger cut posed risks to the Fed’s twin goals of low inflation and full employment.

After the conclusion of the Fed meeting, and previously following the annual Jackson Hole Symposium in August, Fed Chairman Jerome Powell’s comments revealed a shift away from concerns about inflation. Of greater concern to him is the softening employment situation. Hence, the decision by most Fed members to be more aggressive than the “normal” quarter-point adjustment.

FEDERAL-FUNDS TARGET RATE

Source: Federal Reserve, WSJ

At the start of the year the unemployment rate was 3.7%. Throughout the first half of 2024 job growth slowed and the unemployment rate spiked, reaching a peak of 4.3% in July. According to the September employment report, the U.S. economy created 254,000 new jobs and the unemployment rate fell for a second straight month, down to 4.1% according to the latest estimate.

Perhaps on the minds of the Fed members, when voting on the size of the rate reduction, was an August report from the Department of Labor indicating jobs gains may be far fewer than previously reported. Annually, the Labor Department compares data from state unemployment-tax records to those reported monthly by the Bureau of Labor Statistics (BLS). While BLS data is timely, state-by-state unemployment-tax records are more comprehensive. In its initial comparison of the April 2023 – March 2024 period, the Labor Department estimated more than 800,000 fewer jobs may have been created than the BLS had reported. Complete results of this evaluation will not be available until February.

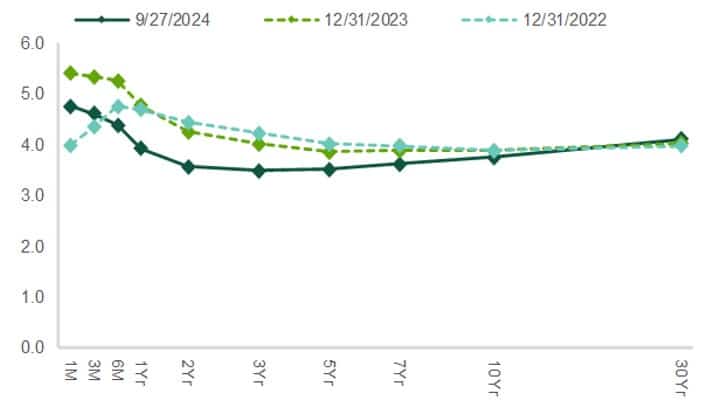

As expected, when it became clear it was only the amount of the initial Fed rate reduction that was in question, interest rates began to drop. Having started the year with a steeply inverted yield curve, meaning short-term rates were higher than long-term rates, the Fed’s decision to begin lowering rates began the process of “normalizing” the shape of the U.S. Treasury yield curve. Expectations are for additional accommodative monetary policy moves at future meetings, which would flatten the yield curve further and continue the normalization process.

U.S. TREASURY YIELD CURVE

Source: Northern Trust Asset Management; Bloomberg

The Fed seems confident inflation will continue to ease toward its two-percent target. Its preferred inflation measure, the core (less food and energy) personal consumption expenditures (PCE) price index, ticked up a bit according to the most recent August reading, which was expected. At 2.7%, core PCE is still trending lower and is well off its near-term peak reading of 5.7% (February 2022).

In the third quarter, stocks continued to defy most investors’ expectations. Having already completed quarters one and two with broad market (Standard & Poor’s 500 Index) returns of 10.6% and 4.3%, respectively, the S&P 500 Index returned 5.9% in the third quarter. The Dow Jones Industrial Average and the NASDAQ Composite Index returned 8.7% and 2.8%, respectively, over the same period. Year-to-date through September, the Dow, the S&P 500, and the NASDAQ had total returns of 13.9%, 22.1% and 21.4%, respectively.

International stocks have done well thus far in 2024, though not as well as U.S. stocks. In the third quarter, the MSCI EAFE Index and the MSCI Emerging Markets Index returned 7.4% and 8.8%, respectively. Year-to-date through the end of the third quarter, the two indices returned 13.6% and 17.1%, respectively.

The U.S. economy continues to expand, driven by resiliency in consumer spending, even in the face of some headwinds being felt by some of the population. Through the first half of the year, real gross domestic product (GDP) grew at an annual rate of 2.2%, with the potential for a stronger outcome in the third quarter. The current GDPNow model from the Federal Reserve Bank of Atlanta is forecasting 2.5% growth in the third quarter.

The aforementioned consumer headwinds include the softening labor market and real income growth running behind real spending growth over the last year. The fallout of weaker economic conditions has been an increase in delinquency rates on autos and credit cards, which are now above pre-pandemic levels, and household savings rates falling to a two-year low. While lower interest rates are a welcome sign to those stretched in the current cycle, it is uncertain whether it will reverse the negative trends that place the economy in jeopardy of going into a recession.

Having weathered what is often the most volatile quarter of the year for stocks, uncertainty remains. The market is still overvalued compared to historical norms, though it is largely limited to the growth-oriented segments that have been driven by the artificial intelligence (AI) craze of the last couple years. The upcoming presidential election, coupled with widespread global geopolitical uncertainty, is sure to be on the minds of investors as they navigate the final quarter of the year.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that Investments and other non-deposits are not deposits, not FDIC insured, not guaranteed by the bank, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor