Meet Cathy Trimmer, Wealth Management Client

Dan Trimmer woke up every day and did what he loved most: farming. His dad was a farmer, and he followed in his father’s footsteps on a patch of land in Fairfield County, Ohio.

His wife, Cathy, was a schoolteacher by day and would occasionally bale hay. She knew the land was Dan’s baby and something he cared for deeply.

When heartbreak struck the couple, Cathy found herself alone and unsure of what to do to keep her farm, family and herself financially secure. Luckily, she knew just who to call.

The associates at her local Park National Bank office were there to not only guide her through the steps necessary for financial security, but to comfort her and ensure her she wasn’t alone. They had her back.

Dan ran a tight ship when it came to managing the farm. But like any business, it wasn’t easy. He understood that while he had to be nimble and accept the unexpected as it came – he wanted to be prepared should anything happen to him.

But while there might be pivots in some daily tasks, Dan always had good control of the overall operations and finances. And since the 1970’s, he trusted Park National Bank (previously Fairfield National Bank) to help him make the right decisions for his business and his family.

Cathy, while not heavily involved, couldn’t help but notice that each Park associate they encountered made decisions based on what was best for the Trimmers, not necessarily for the bank.

“The bankers really understood farming,” Cathy said. “Most banks don’t. It’s so important to have a bank that understands farmers and builds financial strategies and safeguards that protect their businesses.”

News they never expected

In 2019, Dan started experiencing health issues and was quickly diagnosed with stage 4 prostate cancer. Devastated, the couple knew it could only be a matter of time before his condition worsened.

Yet, he continued to wake up every day and tend to his farm over the next few years. While visiting their daughter in Colorado in 2021, Dan experienced high fevers and soon learned his kidneys were failing. It was at this point that he knew his time was limited, and recognized he needed to reach out to his representative at Park National Bank.

The assistant branch manager, Angie, met with the couple and made sure everything was in place and as the couple wished. She added Cathy’s name to all the accounts, so she’d have full access to everything when needed.

Angie also made sure Cathy knew that when the time came, she and her team would be by her side to help her navigate the next steps.

“She pulled me aside to tell me that when Dan was nearing the end of his journey, to be sure to come see her,” Cathy said. “She was looking out for me.”

Facing tragedy head on

In January 2022, Dan’s health would no longer allow him to farm. Later, in May of that year, he succumbed to his illness and passed. Cathy found herself overwhelmed, having to manage plans for his funeral, while facing the uncertainty of what would come next for her.

“Who would run the farm? How can I manage all the finances?” she thought.

But through her time of grief and uncertainty, her bankers at Park stepped up. Cathy found immense comfort in the same people her husband trusted for so many years.

“Nicole, a Park wealth management administrator, came to Dan’s funeral,” she said. “Laura, the chief banking officer, called me from Michigan just to check on me.”

“It was clear that these people were more than just Bankers. They cared for me and my wellbeing,” Cathy said.

“The whole time, my family kept telling me to take my money out of Park and put it into a bigger bank to try to grow it faster. But the way Park National treated me and Dan, why would I move my money anywhere else?” I told them, “I’m sticking with Park.”

In the right hands

Later, Nicole from Park reached out to let her know she was ready to help when the time was right.

“She called and said, ‘whenever you’re ready – come see me and we’ll take care of everything.’”

Cathy set up an appointment and couldn’t believe what Nicole showed her. Through Dan’s goal planning and the Park team’s guidance, the couple had grown a nest egg that would leave her financially secure for the rest of her life.

Nicole and Luann, the local T&I Regional Director, walked her through all of the options of what she could do with the money. Cathy wasn’t just shocked at the amount, but at how the bank carefully and patiently worked with her to make sure it was distributed in ways that were best for her and her loved ones.

Overcome with joy and relief, Cathy broke down and cried.

When she talks about how she felt in that moment, Cathy explains, “They have created a security blanket for me. They are my life saver. They have taken the burden off my plate.” She added, “Whether I had a million dollars or just five, I know they would have treated me the same way.”

A grateful customer

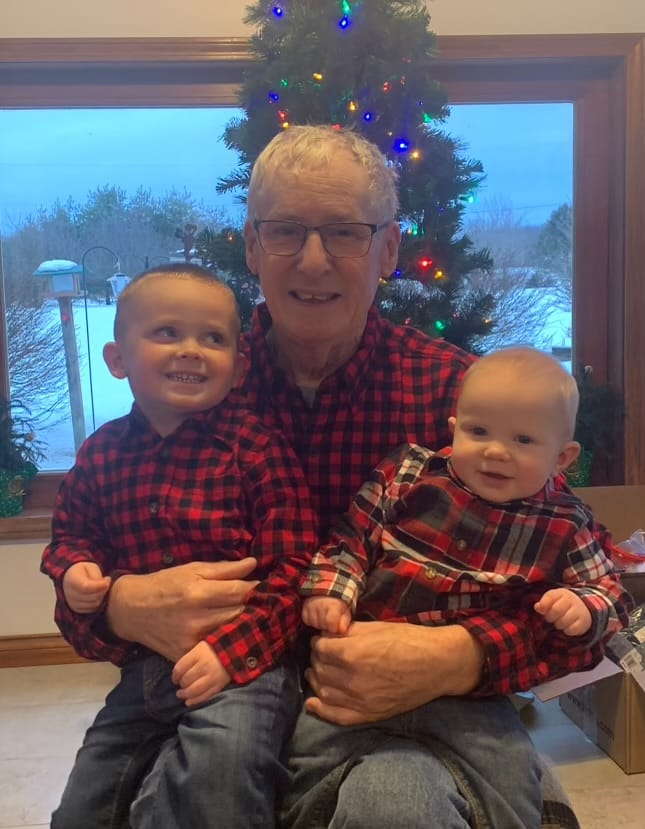

Cathy decided to pad up her security blanket and, with Nicole’s help, created a trust for her two grandsons.

The farm is still tended to by others, but Cathy now spends her days volunteering, reading, visiting with family, and walking her dog. She still gets regular updates about the status of her finances and is beyond grateful that everyone at Park helped her make decisions that kept her family’s best interests at the forefront.

“I think the world of Park,” Cathy concludes. “They were there when I needed them. They are with me now. And they’ll be there in the future. I trust them.”