Market Comments: Q22023

July 2023

At the start of 2023, many economists were forecasting a likely recession to begin sometime in the first six months of the year. The U.S. economy, however, has proven its resilience even in the face of rising interest rates. Fueled by positive employment reports and strong consumer spending, first-half economic growth estimates exceeded expectations.

Last week, the final estimate of first quarter gross domestic product (GDP) indicated the U.S. economy grew at a 2.0% annual rate, significantly ahead of the previous 1.3% estimate. The higher estimate reflected improvements in exports, government spending, nonresidential fixed investment and consumer spending. The first estimate of second quarter GDP will be released at the end of the month. The current GDPNow forecast of second quarter growth is 2.1%.

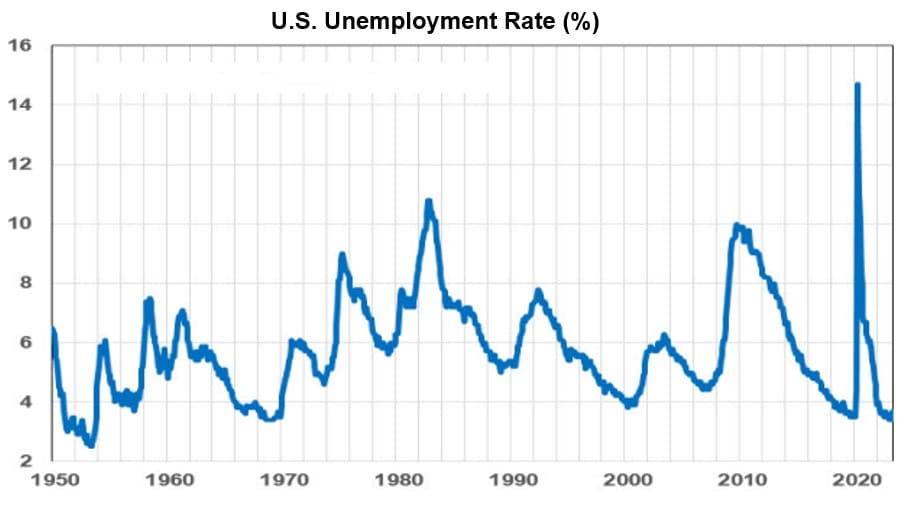

June employment data came in a bit below the forecast, with 209,000 jobs created versus the forecast of around 240,000. Nonetheless, employment statistics remain relatively strong. About a year ago, the U.S. economy regained pre-pandemic employment levels, meaning the nearly 5 million jobs created over the last year are not simply refilling the hole created by the pandemic. Rather, they represent growth in the employment base, which has kept consumers spending and the economy growing. The June unemployment rate ticked down just a bit to 3.6%.

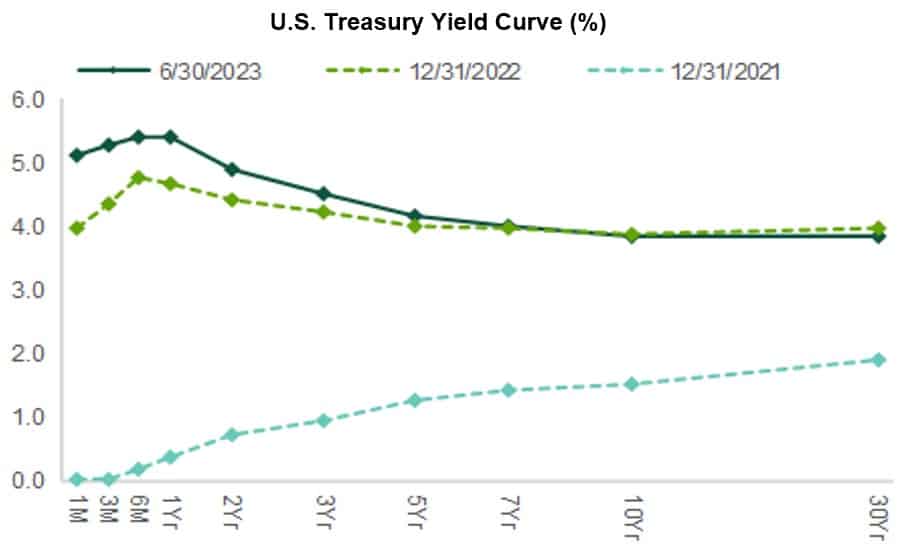

May’s 4.0% consumer price index (CPI) estimate, while well below the 9.1% near-term peak in June 2022, remains above the Federal Reserve’s 2% inflation target. Following 10 consecutive rate increases dating back to March 2022, Fed officials decided to pause at the June meeting, citing concerns over economic growth and the lagged impact of previous increases. The rate-hike campaign lasted 15 months and totaled 5 percentage points, the most aggressive moves since the high-inflation period of the early 1980s. A survey conducted at the June meeting indicated nearly all members expect further policy tightening this year, with two additional 0.25% rate hikes all but penciled-in.

Interest rates were volatile in the second quarter, particularly at the short end of the U.S. Treasury yield curve. Early in the quarter, concerns over the stability of the banking sector drove many bank deposits into the safety of government-backed securities. The increased demand drove rates to around the lowest levels of the year. Bond prices and interest rates move inversely.

Just about the time concerns of a spillover of the banking sector into the broader economy began to wane, a stalemate related to increasing the debt ceiling stoked fear a resolution would not beat the deadline, potentially resulting in a default on government-backed debt. Investors fled short-term U.S. Treasury Bills, driving prices down and yields higher. Ultimately, Congress and the President agreed to a resolution. By quarter’s end, yields across most of the curve were higher than at the start of the year. Early this month, the 2-year Treasury Note pierced the 5% mark, a level not seen in 16 years.

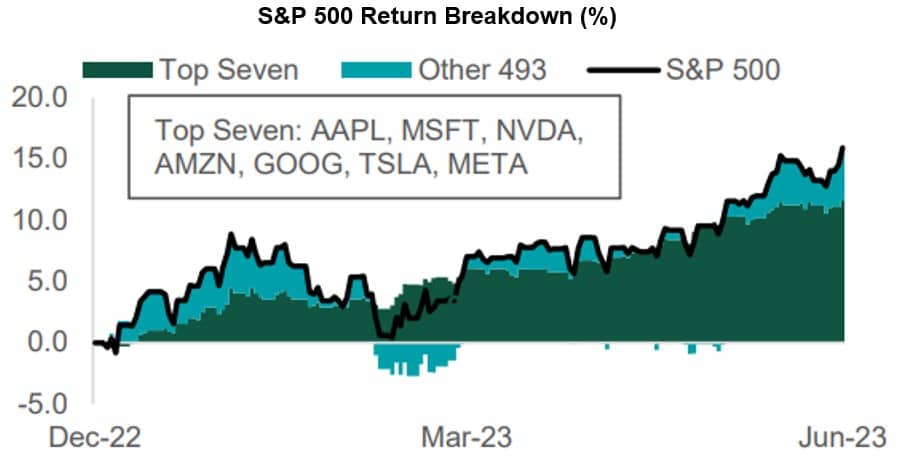

Though somewhat erratic, stocks continued to perform well. The Dow Jones Industrial Average, the Standard & Poor’s 500 Index, and the NASDAQ Composite Index returned 4.0%, 8.7%, and 13.1%, respectively, achieving a third consecutive quarter of positive returns. The disparity in the mid-year returns of the three indices is even more pronounced than the quarterly returns. Through the first six months of the year, the Dow, the S&P 500 and the NASDAQ returned 4.9%, 16.9% and 32.3%, respectively.

Unlike last year, when rising interest rates served as a headwind to many large, technology-related stocks, those same companies have benefitted from an improving economic outlook this year. In particular, artificial intelligence (AI) investments experienced heavy investor interest. As of June 8, the broad U.S. stock market (S&P 500) exited bear-market territory (20% off a near-term low).

There has been little breadth to the rise in stock prices, with nearly all of the gains thus far coming from just a few of the largest companies (by market capitalization). Prior to June, in which all 11 sectors had positive returns, the collective returns outside of the top seven holdings in the S&P 500 were slightly negative. Those seven stocks (Apple, Microsoft, Nvidia, Amazon, Alphabet, Tesla, Meta) continue to account for a majority of the returns thus far in 2023.

With debt ceiling negotiations now off the table until early 2025, and the worst of the instability created by the bank failures seemingly in the rearview mirror, investors are now left to focus on fundamentals. The run-up in stocks has stretched valuations a bit beyond the “normal” range, but forward earnings guidance is improving, as is the possibility of a soft landing rather than an eminent recession. It is likely, if not probable, that future employment reports will dictate whether our consumer-driven economy can continue to overcome future challenges.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that investment products are not FDIC insured, not bank guaranteed, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take any action which may be relevant to this information.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor