Market Comments: Q12023

Hopes of a significant reprieve from the uncertain economic and financial market conditions of last year faded fairly quickly over the first three months of 2023. While stocks achieved a second consecutive quarter of very strong returns, the path in getting there resembled that of a roller coaster. Globally, stocks started the period strong, before falling off a bit mid-quarter, then recovering in the latter part of March.

Of the stock indices we follow closely, the Standard & Poor’s 500 Index is the best measure of the “broad” U.S. stock market. In comparing returns in the fourth quarter of last year to the first quarter this year, one might conclude conditions were similar. The total returns of the S&P 500 over the two periods were 7.6% and 7.5%, respectively.

However, there was a significant contrast between the two quarters, as investors shifted back into growth-oriented sectors like technology and consumer discretion in the first quarter, and away from value-leaning sectors like financials and energy. This dichotomy is reflected in the returns of the other two major U.S. stock market indices, the Dow Jones Industrial Average and the NASDAQ Composite Index. Total returns for the Dow and NASDAQ in the first quarter were 1.0% and 17.1%, respectively, nearly a complete reversal of last year’s fourth quarter, where returns of the two indices were 16.0% and -0.8%, respectively.

No doubt part of the reason for weakness in the financial sector was due to concerns about the stability of the banking industry, as the 2nd and 3rd largest bank failures in U.S. history occurred at Silicon Valley Bank (SVB) and Signature Bank. After suffering major deposit outflows, regulators took control of both institutions, and U.S. policymakers stepped in with emergency liquidity measures in an attempt to help stabilize the banking industry.

It is important to make a distinction between banks like SVB and others, including Park National. Those in the banking industry are familiar with the acronym “MRA.” MRAs, or matters requiring attention, are citations issued by a bank’s regulatory body identifying vulnerabilities in a bank’s operating model. Leading up to the collapse of SVB, the Federal Reserve Bank of San Francisco, which oversaw SVB, issued six MRAs that identified various areas of risk and weakness. Perhaps most ominous was the opinion of the Fed that SVB would be unable to access adequate liquidity in the event of a run on deposits, which is exactly what occurred.

It was the Federal Reserve’s response to inflationary pressure, which peaked last year at 9.1%, that exposed banks like SVB that had taken on significant interest rate risk by buying long-term securities in their investment portfolios. Over the last year or so, the Fed has raised the Fed Funds target rate from near zero to almost 5%, causing significant weakness in fixed-income investments (interest rates and bond prices move inversely).

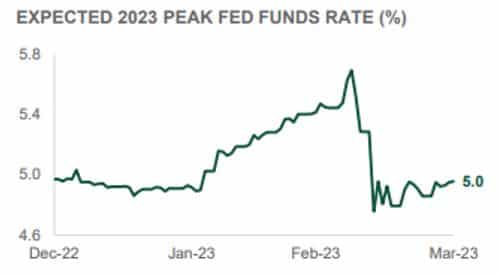

In the first quarter, expectations for future Fed rate adjustments shifted violently as early economic data releases indicated stronger than expected growth and stickier inflation. That all changed when the banking crisis began to unfold, as identified on the chart below. Current Fed Funds futures indicate the likelihood of one more 0.25% rate increase to around 5% at the Fed’s May meeting, followed by a several-month hiatus, and possible rate reductions as we near year-end.

The most recent data indicates inflation continues to trend downward. The February Consumer Price Index (CPI) was 6.0%, down from 6.4% in January. However, inflation remains elevated and well above the Fed’s 2% target. Fed Chairman Jerome Powell, in recent testimony, indicated the Fed’s expectation that inflation will remain stubbornly elevated for longer than originally expected.

An area of resilience throughout all of the challenges of the last several months has been in employment data. In January, the unemployment rate fell to its lowest level in more than 50 years, at 3.4%. The most recent March data showed unemployment at 3.5%, with 236,000 new jobs created in the month. The 6-month average of new jobs created is 334,000. Over the last 12 months, average hourly earnings increased by 4.2%.

Overall, the economy continues to expand at a decent pace. The third and final gross domestic product (GDP) reading for the fourth quarter of 2022 came in at 2.6%. The increase in GDP reflected improving consumer spending and inventory investment, while weakness remained in housing investment. The initial estimate of first quarter 2023 GDP growth will be released later this month, with expectations of around 2.5% growth. The current GDPNow estimate, based on known economic data, is just 1.5%.

In uncertain times like those that have persisted the last few years, it is helpful to be reminded that these are not the first such challenges investors have encountered. While we anticipate the possibility of continued instability in financial markets, we are resolute in our belief it is prudent to remain invested in a well-diversified portfolio that matches an investor’s risk profile. As always, our associates are available and willing to help address any concerns you may have as a result of the recent market and economic volatility.

This material is prepared for informational and educational purposes. It is not and should not be interpreted or relied upon as financial advice, a recommendation for the purchase or sale of securities or other financial products and services, or for tax, legal, or accounting advice. We make no representation as to the accuracy or completeness of the information. With respect to information regarding financial performance, past results are not an indication of future performance. Please know that investment products are not FDIC insured, not bank guaranteed, and may lose value. You should consult your professional advisors regarding the matters discussed herein and your own individual circumstances before taking or declining to take any action which may be relevant to this information.

Start planning for a stronger financial future.

Let us help you build a tailored plan that will help you achieve your financial goals.

Find an Advisor